Risk Management That Keeps Pace with Your Trading Desk

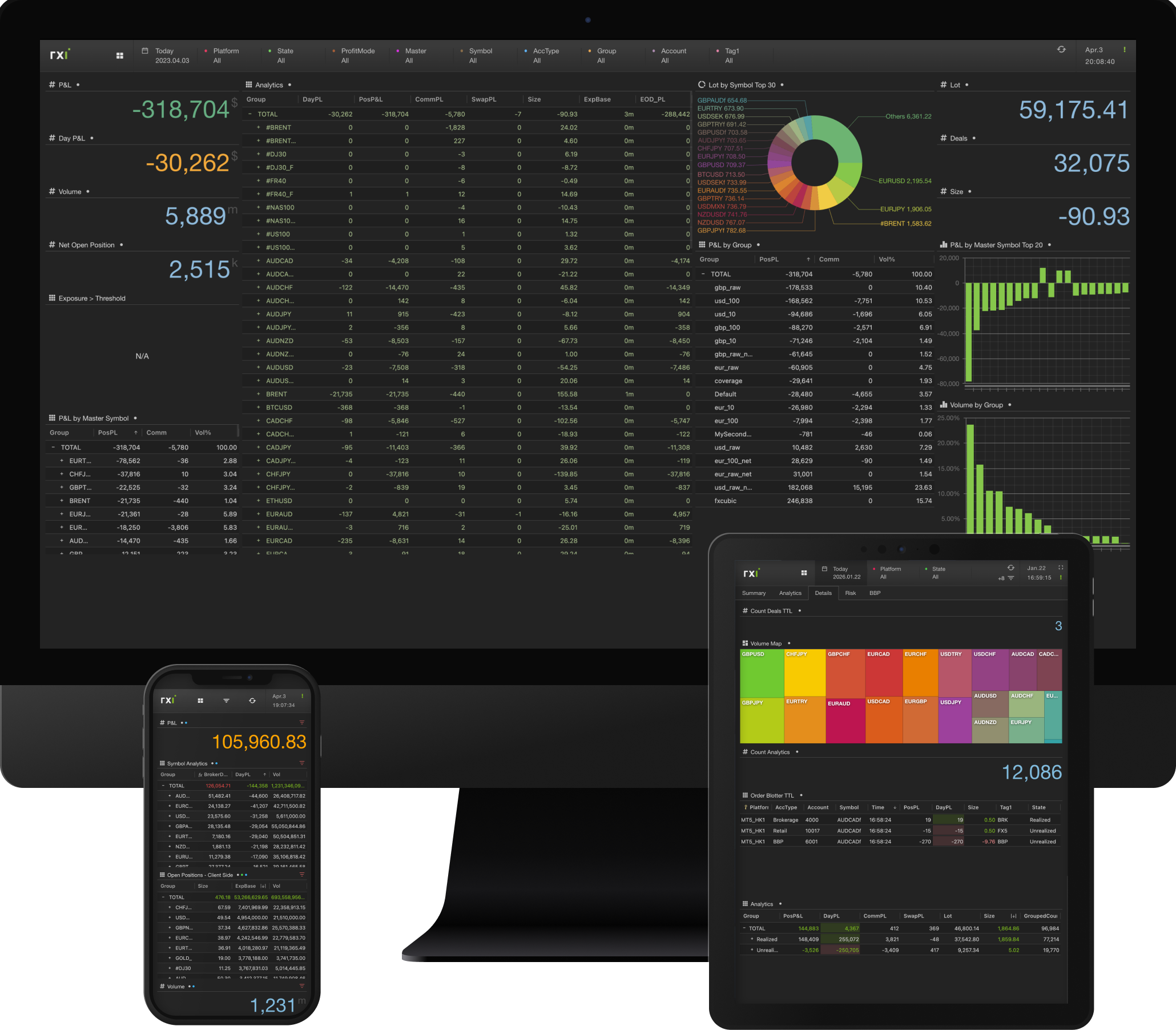

RXI is a real-time risk management and business intelligence solution for brokers.

RXI analyses and reconciles risk data simultaneously, providing data-driven profit opportunities by giving brokers real-time information to take timely actions. RXI updates broker positions and P&L with real-time customisable information from any number of trading platforms. It is an essential tool that allows clients to assess their entire risk and exposure centrally.

Benefits

Comprehensive tools designed to give you complete control over your trading operations.

- Endless Customisability

- RXI provides you with the tools to configure the KPIs you want to track. Customisability tools such as different widget types, dimensions, measures are all available and contain personalisation features for every field.

- Real-Time Monitoring

- All data gets updated in real-time with no delays. Never lose the value of your data whilst carrying out analysis.

- Customisable Filtration

- See the root of complex events instantaneously with an advanced filtration system. Allowing to assess data dynamically, the output data can be filtered, and different real-time pivot tables can be created at lightning speed.

- Standalone application

- Connects directly to the trading platforms ensuring uninterrupted performance and no conflicts with other plug-ins. Direct connection allows for a quick and easy setup process.

- Multi-platform connectivity

- Integrated with industry leading trading platforms, and able to connect to all of your trading platforms. Follow entirety of your risk through one central application.

- Automated actions - bridge integration

- Take automated actions using real-time data available in RXI with the FXCubic bridge integration. Adapt to the quick changing needs of the market and never get left behind. You will always be a step ahead of your potential losses. Manage your book distribution like you have never done before.

Features

Advanced functionality for sophisticated risk management and analysis.

- Custom Functions with Expressions

- Use personalised formulas to add another layer of customisability, and get ahead of the competition with bespoke metrics you create.

- Profitability Analysis

- Monitor P&L in real-time and group your data according to accounts, account groups and A/B Book.

- A/B Book Monitoring & Dynamic Switching

- Follow all your A/B Book positions in an aggregated view and decide on A/B Book switching in real-time using the automation tools of the bridge integration.

- Automated Daily Reports

- Configure and automate your reports with their frequency options for your dealing desk and management. Get these reports on the go by using RXI’s external channel integrations.

- Push Notifications

- Get notified when your custom thresholds are met. The live alerting system provides another layer of security for your risk monitoring as it leaves no space for missing important events happening in your platform.

- Toxic Activity Detection

- Advanced identification measures in RXI allow you to monitor any toxic activity in real-time. You can take action to minimise your risk with no time wasted. Get in depth analysis regarding scalpers and latency arbitrage traders.

- Real-Time VaR Analysis

- Calculate Value at Risk in real-time to understand potential losses.

- Decay Analysis

- Get deeper insights using the customisable markout analysis.

- Historical Analysis

- Spot trader behaviour over time and label traders according to their trading habits, including identifying historical toxic traders. Monitor winners and losers in your trading platforms historically and decide on actions according to their expected return calculation.

RXI has even more capabilities.

Discover the full potential of our platform. Book a demo today to see how RXI can transform your risk management.